IDEX Online Research: Blue Nile Picks Up Market Share in 2009

February 21, 10 by Ken Gassman

Sales surged at Blue Nile in the fourth quarter, and the online jeweler took market share from both specialty jewelers as well as other merchants who sell jewelry.

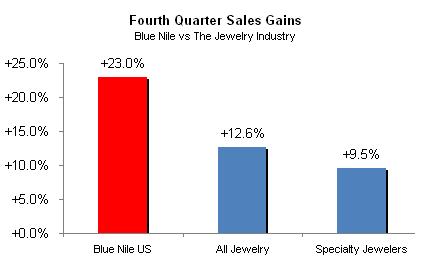

On a comparable 13-week basis, Blue Nile’s total sales – domestic U.S. and international – in the fourth calendar quarter of 2009 rose by 27.4 percent. The company did not break out domestic sales versus international sales on a comparable 13-week basis, but we believe that U.S. sales were up about 23 percent on a comparable basis. Thus, Blue Nile’s domestic sales gain was well above total jewelry sales gains (all merchants, including discounters, specialty retailers, and others) of 12.6 percent and also far above the 9.5 percent fourth quarter gain posted by specialty jewelers as the graph below illustrates.

|

Source: Blue Nile and IDEX Online

|

It is even more impressive that Blue Nile was able to generate a higher gross margin, both in the fourth quarter and for the full year, while at the same time reporting such strong sales gains. Clearly, the company did not “buy” sales with heavy price-based margin-eroding promotions.

The Blue Nile formula for success is worthy of close scrutiny. While many store-based jewelers grouse that online retailers such as Blue Nile and others have taken market share away from them, it is important to remember that for every successful online jeweler, there are at least ten who failed. If every start-up online jeweler were still around, online jewelry sales could be as much as 20 percent of total industry sales, rather than the current estimated 4-5 percent of total jewelry sales.

The following table summarizes highlights of the company’s fourth quarter financial results.

The following table summarizes highlights of Blue Nile’s full year financials.

Blue Nile’s operating results were affected by the following:

· Total sales in the fourth quarter were up a reported 20.0 percent. However, this included a 14-week fourth quarter in 2008 versus a 13-week fourth quarter in 2009. On a comparable 13-week basis, Blue Nile’s fourth quarter sales rose by a robust 27.4 percent.

o Domestic U.S. sales rose by 15.6 percent (14 weeks vs 13 weeks) to a reported $91.2 million, or about 86 percent of total corporate revenues. Domestic U.S. sales rose by about 23 percent on a comparable 13-week basis.

o International sales rose by 59.4 percent (14 weeks vs 13 weeks) in constant currency. Prior to adjusting for currency fluctuations, international sales rose by 69.6 percent. International sales were about 14 percent of Blue Nile’s total fourth quarter sales of $102.9 million.

o By product category, Blue Nile reported that it “saw exceptional strength in the diamond jewelry category.” That category includes diamond engagement rings, but it is important to note that it also includes other diamond jewelry such as bracelets, earrings, and necklaces.

o In addition to diamond jewelry gains, other gemstone jewelry and sterling silver jewelry demand was strong.

o By price point, every price category showed gains, including jewelry priced above $25,000. In prior periods, demand had been weaker for big-ticket jewelry.

o Blue Nile management has indicated that they will no longer report detailed data on the total number of orders processed in a quarter, nor will they report the average ticket. However, management did say that the company had strong growth in both total orders and the average order value.

· Blue Nile’s full year sales were $302.1 million, or roughly the equivalent of 275 specialty jewelry stores, based on the latest sales per store data from Jewelers of America which showed that the typical U.S. specialty jeweler generates about $1.1 million in annual sales per store.

o Total annual reported sales rose by 2.3 percent, based on a 52-week year in 2009 versus a 53-week year in 2008. According to information in last year’s 10-K and this year’s press release – which doesn’t quite correlate – we estimate that total annual sales on a 52-week comparable basis rose by 3.7 percent in 2009.

o Reported domestic annual sales rose by just under 1 percent, while reported international annual sales (constant currency) rose by 27.4 percent. International sales for the year were $33.2 million, or 11 percent of total corporate revenues.

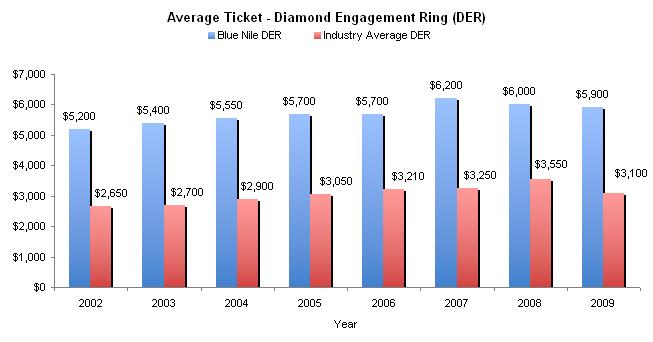

o The average ticket for a diamond engagement ring in 2009 was $5,900. The graph below illustrates the average ticket for a diamond engagement ring (DER_ at Blue Nile versus the industry average for the past several years. Blue Nile’s average ticket for a DER is about double the industry average. However, the industry average varies significantly by retailer: small chains and independent jewelers’ average DER ticket was about $4,800 in 2007 (the latest data) while the average ticket for DER at large chains was about $2,700 in 2007.

Source: Blue Nile and IDEX Online |

o Diamond engagement rings represented about 69 percent of Blue Nile’s revenues in 2009, about flat with prior years.

o Blue Nile management noted that its top performing product categories for the year were its core diamond engagement rings and wedding bands.

· For both the fourth quarter and full year, Blue Nile’s gross margin rose by over 100 basis points (1 percent), as indicated on the tables above. Management attributed this margin gain to sourcing improvements for both diamonds and jewelry.

· Blue Nile’s year-end inventory rose by about 3 percent, roughly in line with the annual sales growth, but well below fourth quarter sales increases. Management noted that the annual inventory turn increased to 13.4 times, up from last year’s 12.5 times. Our more conservative calculations show an inventory turn of about 12.2 times, still dramatically above the average inventory turn of 1.0 times for specialty jewelers.

· Management’s outlook for the early part of 2010 is bullish. While the company did not forecast annual revenues or profits, it did predict that first quarter revenues would likely be between $71.5 million and $75 million versus $62.4 million in 2009’s first quarter. This suggests that first quarter revenues will likely be up 15-20 percent over last year. Profits could be up by a slightly smaller amount, though management did not provide an explanation for this apparent lack of leverage. Management noted that demand for jewelry with a retail price above $25,000 has remained exceptionally strong into the first quarter of 2010.

· Blue Nile’s management outlined three key areas of focus for 2010, including the following:

o Enhance the customer experience to drive growth in its U.S. business. The company will continue to add new features and functionality to leverage its website. Management said, “We will invest in hundred[s] of details across the customer experience.”

o Pursue further growth in international markets.

o Laser focus on profitability.

In addition, management said it would continue to enhance its assortment of diamond rings, diamond jewelry, gemstones, platinum jewelry, sterling sliver jewelry, and pearls. Further, it has begun to offer watches which it sources from a third party. These watches are not being held in Blue Nile’s inventory, which indicates to us that they are being held by suppliers, similar to the diamonds that Blue Nile sells. Blue Nile has built its business using other people’s (vendors) money; we think this makes excellent business sense