Price Trends and the Forces That Shape Them

August 22, 12

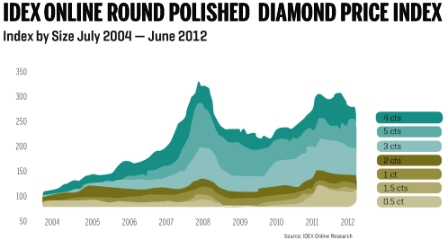

The IDEX Online Polished Diamond Index was introduced on July 1, 2004. The Index is derived in real-time from actual asking prices of the global diamond industry, objectively reflecting price trends as they happen.

Comprised of 15 drivers that represent the leading diamond categories accounting for approximately 45 percent of polished diamond trade, it is updated on a daily basis. The IDEX Online diamond database includes inventories of major industry players accounting for approximately 75 percent of the global diamond trade.

|

|

Since its launch, the index has risen by approximately 36 percent.

During its first four years, from mid-2004 to early 2008, diamond prices increased moderately, as the global consumer economy improved and backed by continuously rising rough diamond prices.

|

In 2008, prices started to escalate in a delayed response to the rising markets, reaching a record high in June of that year just ahead of the key U.S. trade fair JCK Las Vegas and peaked in August at 128.91. Following the global financial crash, diamond prices rolled back to mid-2005 levels reaching a low of 108.56 in September 2009.

The 2009

|

This led to quickly rising rough diamond prices that started to pressure manufacturers to increase the price of polished. This momentum continues until today, backed, as mentioned earlier, by large and growing demand from the Chinese and Indian consumer markets and a recovering

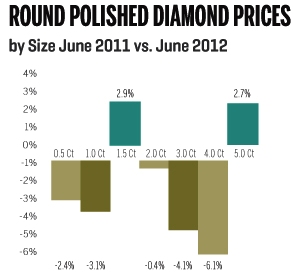

In June 2011, polished diamond prices broke records after bottoming in September 2009. Within a year, polished diamond prices rose by 15.8 percent, according to the IDEX Online Polished Diamond Index. This is the largest such price increase since pre-crisis June 2008, when prices shot up by 14.5 percent year-over-year.

|

Further, prices have risen almost every month since the last quarter of 2009 and throughout 2010 through August 2011. In the first half of 2011, unprec

In today's post-cooling period, after they plateaued, prices of polished diamonds are declining. This is a response to uncertainty in some global markets, and vigilance in the more stable countries such as