Delivering Diamond Value With A Weak Rupee

August 31, 12

|

The weak rupee, combined with Europe’s debt crisis, the US economy’s struggle to get back on its feet and the realization that India isn’t entirely insulated from either of them, has depressed consumer sentiment significantly. The ‘feel good factor’ has gone to a great extent.

While the Indian gem and jewelry industry is struggling to cope with consumers who seem disinclined to buy, the weak rupee has made gold so expensive that it is no longer the blindly sought-after commodity it has been in this country.

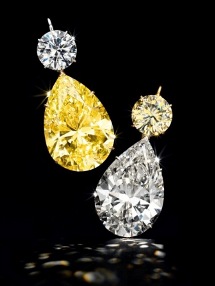

Worse, the weak rupee has landed a second punch by also making diamonds significantly more expensive. As with gold, diamond prices have risen so sharply and in such a short time that consumers are no longer confident about the diamond’s value.

This is what the gem and jewelry industry is faced with in the run up to the Diwali sales season – the single biggest sales period of the entire year. “We have to do something in terms of communicating directly with the consumer,” says Sanjay Kothari, Vice Chairman of the Gem & Jewellery Export Promotion Council (GJEPC), “all this while, we’ve piggybacked for free on either somebody else’s efforts or an age-old social phenomenon – that has changed completely.”

Kothari is referring to the fact that the Indian diamond processing industry, the largest in the world by far, has had, until a few years ago, no worries about consumer demand worldwide as mining giant De Beers ran its global promotional campaigns, spending over $200 million (Rs.11 billion at today’s exchange rate) annually.

The global campaign successfully implanted the idea among consumers everywhere that the diamond was the symbol of the relationship between men and women. Even in today’s depressed global markets, the diamond engagement ring has kept the diamond processing industry from total collapse.

Kothari’s other reference is to the fact that in India, the almost religious fervour with which gold has been regarded, has meant that until now, jewelry has not even remotely come close to requiring a hard sell. All that has changed he observed.

Both the diamond processing industry as well as jewelry retailers have in recent times, come around to the idea that unless something is done, a disastrous situation could well result. But what does one do about the weak and volatile rupee, which impacts the price of gold and diamonds?

EXTRANEOUS FACTORS GOVERN RUPEE VALUE

The value of the rupee is governed by several factors, chief among them are the interest rate regime, fiscal deficit, export and foreign investment in India. Added to this are global issues such as the current economic crisis in the Eurozone. This may make investors more risk-averse. As a result, they may reduce their asset exposure from emerging economies like India, thereby selling more rupees.

Also to be factored in is the level of demand for the US dollar in India. Rising oil prices mean more dollars are required by Indian oil companies to import crude oil. Economists say the rupee is likely to remain weak for the foreseeable future.

All these factors put together make it difficult for even the Reserve Bank of India (RBI) to steady the rupee against other currencies. Industry leaders have stated clearly that there is not much the gem and jewelry industry can do about the value of the rupee.

All it can do is focus on generating demand for its product among Indian consumers. Imbuing the diamond with some emotional content specifically for Indians is one way that is now being discussed.

The GJEPC had tried previously, using Bollywood star Sonam Kapoor as it brand ambassador, to push the diamond as the symbol that truly reflected the many facets of the Indian women – a daughter, wife, mother, professional and achiever. The campaign was, however nowhere near the scale of the De Beers ones in terms of financial muscle and reach. Its returns have thus, been limited.

But more needs to be done, warns Kothari. Without some sort of major effort, Indian diamond consumption, currently pegged at Rs.24,800 crore ($4.5 billion) annually, and estimated to be growing at 40 percent a year to hit Rs.33,100 crore ($6 billion) by 2015, could well flounder.

The continuing GJEPC effort this year was seen in media tie-ups in this year’s the India International Jewellery Week (IIJW). With the Star Plus TV channel and the Bombay Times as media partners, the direct outreach to the consumer this year has been substantive. The message has been that unique design and a product that has enduring value are factors that make the buying of jewelry a great decision.

INVESTMENT VALUE MATTERS IN LONG TERM

In the long term, however, instilling value in a product is a tricky business. Research has shown that in India, even with international luxury brands, although value is defined distinctively by a range of varying parameters, the ‘price’ proposition of the value platform continues to be of essence.

Thus even worldwide, luxury assets are perceived to be investments. So for the gem and jewelry industry, the process of developing an emotional value proposition will still have to take into account the weak rupee as the consumer also assesses the product’s return on investment.

Jewelry manufacturers have pointed out that even if the gold content of a piece of jewelry is kept down to the minimum while a ‘large look’ is maintained through the use of hollow castings, if a substantial diamond is used as the centerpiece, the consumer could still wind up being asked to pay tens of thousands of rupees more than it would have cost a neighbour a year ago.

One view being looked at is the ‘bridge to luxury’ concept. This is something that luxury car makers have exploited in the country by introducing significantly lower-priced entry-level models. This pricing ‘bridge’ to the top end of the luxury car segment allows the consumer the ‘luxury experience’ and fulfill the ‘flaunt quotient’ at a price that delivers a feeling of value for investment.

The diamond industry’s parallel idea could be to promote the idea that even if it is of lower quality, just owning a diamond is a special experience.

De Beers has always maintained that ‘buying a diamond always whets the appetite for more diamonds’ and encouraged price segmentation to allow a low entry price-point. Some Indian retailers including market leader Tanishq have done that, taking a very long-term view and going specifically after the youth market (see IDEX Magazine – India Retail June issue).

|

SEEING VALUE IN DESIGN

However consultancy and research firm Technopak has, in an analysis of the emerging trends in luxury consumption in India, noted that “the perception of ‘design’ having intrinsic value rather than the metric of carats and quantity of gold shall be a trend in the coming years. Consumers are more inclined towards classy, unique pieces, crafted by internationally renowned designers, commanding a high ticket price due to the intrinsic value attached to their design.

Taking a cue from this, over the last few years, domestic and international brands have lured the customers with creativity and innovation in design.” The Technopak report goes on to list some of the watch and jewelry brands that have created the concept of delivering value by design: “A few examples amongst others are Longines, Breitling, Omega, Rolex, Morellato, Guess, Cartier, Tiffany & Co., The Gem Palace, Harry Winston, Caratti, Ganjam, Mirari Jewels and Opulence By Jewelex.”

While the industry struggles with product promotion issues and wonder how to generate sufficient sales over the all-important Diwali season, industry watchers say that help may be on the way after Diwali. toward the end of the year, in the form of a diamond price correction.

They note that ill-considered overbidding for rough diamonds by Indian diamond manufacturers was one of the primary causes of the sharp escalation in diamond prices over the past year. Non-existent margins and unsold stocks have, however, brought about a return to realism and along with sharp cutbacks in production which will lessen the pressure to go on buying rough, balance will begin to be restored in the diamond processing value chain by the end of the year.

They caution that the price correction may not be in time to provide any sort of fillip to the year-end-beginning-of-the-next-year marriage season. But the diamond price situation is expected to improve considerably by then.