Rough Review

October 27, 12

By Edahn Golan

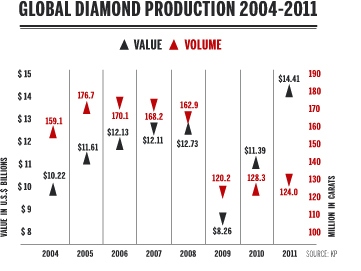

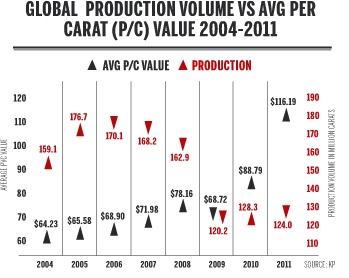

As all the business models predicted for the second decade of the century, rough diamond production is now declining in volume, and soaring in value. In 2011, diamond production declined 3.4 percent to 124 million carats. The value of this production - as stated by producers - was $14.41 billion, up26.5 percent compared to the preceding year. How did this happen, why did it happen and, most importantly, is this the beginning of a long-term trend or just an unusual hiccup?

Many issues are concerning those involved with rough diamonds. Rising prices versus weak polished diamond demand, shifting ownership of the main diamond firms – and some may say the balance of power, the lack of long-term marketing initiatives on the consumer front to generate demand for diamonds, changing selling models and the challenges they pose, an uncertain mid-term economic outlook that is threatening to harm middle-class spending, as well as reputational issues associated with what some deem as an outdated Kimberley Process (KP).

There are also bright spots: the possible entrance of financial institutions interested in investing in diamonds may inject hundreds of millions of dollars into the diamond sector, steady demand from the bridal sector, a deep rooted consumer acceptance that diamond jewelry is an enduring fashionable choice worth its high cost as well as being a long lasting store of emotional value.

Declining Availability From Existing Resources

The decline in production in 2011 is not an odd blip on the map. Global diamond production has been steadily declining since 2005, when it peaked at 176.7 million carats, according to KP reports. The sole increase in production took place in 2010 as diamond miners somewhat revved up production after the 2008-2009 recession and to accommodate the renewed demand for diamond jewelry.

This global downward trend in diamond production is expected to continue, with one small exception, – the commissioning of the underground project at the Argyle mine in Australia. At that point, scheduled for 2013, global production is expected to rise. A lone mine coming on line, however, will not alter the downward trend in diamond production.

|

|

The decline is partially a result of a number of factors, some completely unrelated. For example, Argyle in west Australia, Rio Tinto's largest diamond mine, suffered from heavy rains and flooding that slowed production by 24 percent to just 7.4 million carats in the past year.

Other mines saw production decrease owing to low density ore and lower grade material, which happened to BHP Billiton at the Ekati mine in Canada. In its last fiscal year (July 2011-June 2012), Ekati produced 1.8 million carats, 28.8 percent less than it produced in the prior fiscal year.

Some mining companies, however, decided to lower production due to expected lower demand and a few, according to unofficial estimates, simply want to stretch out the life of their mines. The rationale is that as long as these mines are profitable with a somewhat lower production, they can afford to do it. Part of the underlying principle is that as diamonds become scarcer, prices of rough will rise, and in the longer term this will generate a higher total return and greater income for the companies – as well as for the producing countries. In this context it should be noted that this strategy works well for producing countries for two reasons. First, producing countries' earnings from diamonds are driven mainly from royalties, which are a percentage of the value of the diamond production. Therefore, the higher the value, the greater the income.

The second reason is employment. The second-leading benefit from diamond mining is job creation, along with the accompanying fringe benefits. Local employees are not only gainfully employed, they learn skills, pay taxes and enjoy a range of benefits miners provide, the most common of them being health care for them and their families, including HIV and AIDS programs; education for their children in the form of schools, books, extra-curricula activities and other assistance; and well water purification and supply systems. As long as commercial entities take responsibility and provide these benefits, the governments of many producing countries are spared the need to do so.

Some cynics may say that governments are happy to not have to provide these essential services, while at the same time boasting that they "made sure" diamond miners (and miners of any other local natural resource) do provide these essential social service.

In addition, governments everywhere understand that their natural resources are finite. Once depleted, nothing will replace them, at least no natural resource. Therefore, the longer diamonds are mined on their land, the longer the income it generates in the form of royalties, taxes and other indirect income is available to the states' coffers.

The Top Producers

Nine countries, each producing more than 1 million carats of diamonds annually, supply nearly the entire majority of the world's diamonds. They are: Angola, Australia, Botswana, Canada, Democratic Republic of Congo (DRC), Namibia, Russia, South Africa and Zimbabwe.

Of the 124 million carats produced in 2011, these nine countries supplied 122.2 million carats or 98.6 percent of production by volume. Most of them witnessed their production – and by extension the supply of rough diamonds – decline:

The increase in production in

In this context, Botswana and De Beers are almost synonymous. De Beers is understood to have jumpstarted production a little later than other firms in the period that followed the 2008-2009 economic crises. Either it had a large enough inventory of rough diamonds to meet increasing client demand, it is a large ship that takes a little longer to change course, or simply decided to wait a little longer ensuring that the global economy is indeed improving – the 4 percent rise in Botswana's production may reflect internal issues than an appetite to charge forward.

It should be remembered that during the year between July 2010, when Gareth Penny was fired, to July 2011, when Philippe Mellier stepped in, the De Beers Group operated without a full time, permanent CEO, something that no doubt hindered the company's ability to make large sweeping changes.

The decline in global production, according to early indications, continued deep into 2012. Rough diamond sales by De Beers' Diamond Trading Company (DTC), including those through joint ventures, totaled $3.1 billion during this period, an 11.4 percent decline from the $3.5 billion generated in the first half of 2011. The company did not state how much was sold by volume, however it did say that it scaled back production by 13.6 percent to 13.4 million carats.

BHP Billiton, as stated above, produced 1.8 million carats in the year ending June 2012, 28.8 percent less than it produced in the prior fiscal year. In the third quarter of the fiscal year covering January-March 2012, it mined 433,000 carats and in the fourth quarter BHP Billiton mined 413,000 carats. Together and separately, the output dropped 29 percent year-over-year.

Rio Tinto’s diamond production for the first half of 2012 was 6.2 million carats, 24 percent higher than the first half of 2011; however, this was due primarily to a favorable comparison – the impact of heavy rains and flooding in March 2011 that significantly curbed total production the 2011.

Argyle, in many ways, tells the current story of global diamond mining. It is a rich mine that in 2005 produced 30.5 million carats, including some of the world's most beautiful fancy color diamonds, mainly pinks. In 2009, its production declined to 10.6 million carats and in 2011 fell to just 7.4 million carats. The drop in production is taking place as the mine is slowly depleted, as well as suffering from adverse weather conditions that lead to lost production, as happened in 2010 and 2011.

|

|

As in a few other rich diamond mines, an underground project is underway to extend the mine's life. The underground project at Argyle is expected to lift diamond production to about 20 million carats annually, according to early estimates. Triple the current production.

While this is good news for the mine and Rio Tinto (or whichever company owns it in the future if a Rio Tinto plan to diversify from diamonds materializes), it does not greatly alter the current reality of aging mines past their prime, some uplift in their later years, and a long future of continually shrinking production.

This explains, rather briefly, the decline in global diamond production from existing mines. However, aren't there any new source of diamonds? The short answer is “Yes, but…”

In the past few years, diamond mining and exploration companies have successfully identified a number of new resources. However, some of these resources are not economically viable, and therefore will not be developed and their unearthed goods will not supply diamonds to the global diamond jewelry market.

Other resources are economically viable; however they are few and far between, some with a predicted output that is not very high.

One promising resource is Stornoway's Renard in Canada. It has a probable reserve of 18 million carats that, according to the current plan, will be mined over a period of 11 years. Its diamond production is set to peak at 2.1 million carats per year, averaging 1.7 million carats per year during its life, according to the company. This is probably the most promising diamond reserve that has yet to be mined.

Rio Tinto's Bunder mine in the central Indian state of Madhya Pradesh is slowly nearing full production too. Bunder’s diamond reserves were recently estimated by a company executive at 24 million carats and it is expected to produce some 2 million carats of rough annually during the 10-15 years of the mine's life.

However promising these mines sound, no doubt the most intriguing possibility is in Russia. The country's monopolistic miner and exporter Alrosa stated in May 2011 that the country's total reserves and resources are 1.28 billion carats. This includes probable and proved mineral reserves as well as inferred, indicated and measured mineral resources.

This is a staggering quantity. If accurate, it is not a matter of if the Russian diamond miner mines these goods, but when. At the end of 2010, Alrosa announced it had won the license to mine three new resources in the Russian state of Yakutia. The three resources – the alluvial deposits Ruchey Gusiny and Ebelyakh and the diamond pipe Dalnyaya – have a total estimated resource of 42 million carats. The company is not discussing its long-term mining strategy, however, this and other indications lead us to believe that the company intends to develop these deposits over an extended period of time, pacing itself with the hope of increasing its lead over De Beers as the world's largest diamond producer by volume and – at some future point – by value.

One thing is known. Developing a proven diamond resource is a matter of many years, more so in countries such as

The three mines Alrosa may start developing soon in Yakutia would also take the better part of a decade to develop, even if the Russian authorities fast track the bureaucracy. It should be remembered that these future mines are in Siberia, where the ground is frozen and conditions are harsh, which means that development is slow. As for the other resources Alrosa may decide in the future to develop, they too will take many years to bring to full production.

Unofficially, De Beers estimates that

Putting this in perspective: the existing diamond mines are slowly depleting and all but one – Argyle – are past their prime. There are a few diamond mines that are in advanced stage of development but they will not increase total global diamond production in a very meaningful way. Reported large reserves exist in

Rising Prices

And here lies the first reason for the high value of rough diamond output in 2011. Although diamond production headed downwards, in the first half of 2011 demand for rough diamonds was very high. This was fueled by rising demand (and runaway prices) for polished diamonds by retailers in

Diamond polishers worked hard to meet this demand for polished by increasing production and turned to producers as well as the open market to buy more rough, naturally, when supply is contracting and demand expanding – prices rise.

The large manufacturers turned to their contracted suppliers – De Beers, Alrosa, BHP Billiton and Rio Tinto – trying to increase their supply to meet demand. Whatever they could not buy from the main suppliers they bought from smaller suppliers and the open market.

|

Buying rough in the open – or secondary – market has wide implications. The secondary market is a wild scene. Firsthand buyers – regular clients of Rio Tinto, BHP, Alrosa and most importantly the DTC – buy goods they sometimes do not need. This is typically an outcome of long-term, multi-year contracts that take into consideration long-term planning. They may not need all the goods all the time, and when they do not need a particular item, they turn to sell these goods, usually though brokers, to dealers and manufacturers that purchase rough in the secondary market. At times of high demand, the profits can be huge.

On one hand, the secondary market adds efficiency to the rough diamond sector. Sightholders (contracted clients of DTC), Select Diamantaires (contracted clients of Rio Tinto), BHP Billiton Term and Spot Market clients and others with regular supplies provide the secondary market with the rough they don't need, and their colleagues and firms that do not have a regular supply from the large diamond miners, get access to these goods. In other words, those that do not need a certain category of rough diamonds, supply them to those that do, serving as an indirect conduit for the large miners in the process.

On the other hand, this trade is done at a cost. The simple situation is that a Sightholder buys a "box" of goods from DTC at the DTC list price (a box is a selection of a specific category of rough diamonds that share a certain size range, clarity range and model. This is a reference to a time when DTC brought and showed the goods to Sightholders during the Sight out of boxes).

On top of this cost is a 1 percent broker's fee and an about 1.5 percent Value Added Services (VAS) fee that DTC charges its clients for seminars and other knowledgebase related mainly to marketing. The Sightholder selling the box also wants a certain profit. This means that a buyer will pay, in theory, the box list price, plus the 2.5 percent fees, plus a certain margin. The buyer is paying more for these goods than what he would have been charged if he had a a direct supply. This means that Sightholders and other first-hand buyers have a cost advantage over second-hand buyers, helping their profitability.

The cost above the DTC list price is referred to in the rough diamond sector as "premium," and premiums are, sometimes, the name of the game. At times of good demand, trading in DTC boxes is a very lucrative business. DTC Sightholders can earn premiums of more than 5 percent on a box. At times of high demand, as happened in the first half of 2011 and through large parts of 2007 and the first half of 2008, the premiums were sometimes more than 20 percent. This was a source of huge profits for Sightholders.

At times, demand was so high, that before Sights – the 10 yearly sales of DTC goods to its clients – Sightholders would get advance offers for their 'boxes' from buyers in the market, and the sides would agree on the premium price. By that, Sightholders sold boxes even before they had them (let alone pay for them) and made a very easy and very fast profit on the goods, without having to do anything for it, like winning a lottery ticket even before stopping at the stand to buy the ticket.

As always in an economic ecosystem, the rises are followed by falls, and when demand is very weak, the tables turn. The busy sellers market becomes a buyers market. At such times, buyers are willing to pay less. Their offers are sometimes “at list,” meaning they are willing to pay what the DTC charges – without the added broker and VAS fees, and definitely without any fat premiums – fat or slim. For Sightholders, this is a loss. Some view it stoically, considering it a small price to pay for the large profits they made at better times. Others view it as a necessity. They do not need the goods but do need to generate a cash flow, to show the banks that they are still in high volume business and ensure that their credit facilities are not decreased.

Of course, Sightholders may have goods on the shelf for a while without finding any buyers. At times, they simply store the goods and wait for a when they can sell the goods or polish them, forced to absorb the associated cost this entails – insurance, the cost of money (rough diamond transactions are always immediate, no 90-day credit terms at all.)

Image: Rio Tinto Diamonds |

Today, when the diamond giant supplies 38 percent of the goods by value, prices are susceptible to other forces. First and foremost among them is demand, for the decline in De Beers’ market share resulted in an important outcome: the supplier driven market became a buyer driven market, the supply gave way to demand, and demand is the determining factor today.

Many outside the diamond industry (and a surprisingly large number of those within the industry too) do not see this change or believe the revolution took place. Here is the simple proof: if prices fall and goods are turned down when demand is low (as happened very clearly in May-August of this year); and prices are high and miners are scrambling to produce more in response to high demand – then this is a demand driven market. In a way, it is the consumer – though the retailer, jewelry wholesaler, diamond jewelry maker, polished diamond wholesaler, diamond polisher, rough diamond traders – that is driving rough prices up or down through the entire diamond pipeline.

This is no naïveté. Clearly there are other forces that impact price, but if downstream players have an impact, then this is no longer a supplier driven market. From now on you can say with confidence – “the diamond industry is a demand driven industry!” Amen.

Again, let's put this in its proper context: in 2011, the mining companies mined less rough diamonds for a variety of reasons. Chinese and Indian retailers bought goods at an accelerated rate driving not only polished diamond prices but also demand from polishers to supply more polished diamonds. They in turn bought diamonds at a growing pace, competing with each other and at times willing to pay premiums of more than 20 percent to ensure they have the goods, driving up prices. This is at the basis of KP figures of much higher total value of production despite a sharp drop in production.