Harry Winston and Ekati, the Challenges Are Many

November 15, 12

What can the market expect from Harry Winston Diamonds' purchase of BHP Billiton's diamond business? Prima facie, an established and experienced Canadian miner, with a high-end and successful diamond-jewelry retail operation, widened its mining operation, strengthening its position according to its "Bookends" philosophy. A closer look, however, reveals a far more complex picture and raises a number of important questions.

Harry Winston already has a 40 percent interest in the Diavik mine in

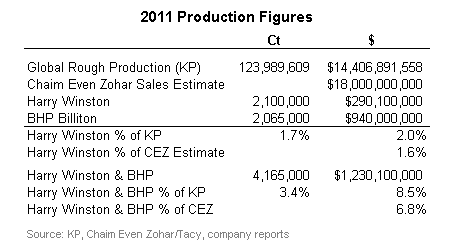

By value, compared to KP's $14.4 billion global production values (a figure far below what miners charge their clients), Harry Winston sold just 2.0 percent of the supply to the market. Compared to Chaim Even-Zohar's estimate of $18.0 billion mine sales to industry in 2011, Harry Winston sold 1.6 percent of the global supply.

Paired with BHP Billiton's 2011 Ekati production and revenues, the combined supply in 2011 is 4.165 million carats sold for $1.23 billion, or 3.4 percent of global production and 6.8 percent of mine sales to the industry.

This clearly improves Harry Winston's ranking in the market, making it the fourth largest miner by volume (after De Beers, Alrosa and Rio Tinto), and the third biggest miner by value, larger than Rio Tinto.

The Surprise

The announcement that Harry Winston bought BHP Billiton's diamond business comes as somewhat of a surprise to diamond insiders. It was known that it was a leading candidate all along, however, it relies heavily on bank credit and was not expected to be able to pickup the extra credit needed to make the purchase.

Chair and CEO Robert Gannicott reportedly made a number of overseas trips to roundup financial support in the past year. Talk of selling the retail operation has been circulating as well. It may generate the needed extra cash, but disassemble the “Bookends,” leaving it as a miner without a place to sell its goods, with all the polished and retail data discovery that comes with it, not to mention the brand equity.

Secondly, the price is a surprise. $400 million for the Core Zone where the mine and other permitted kimberlite pipes are located, and another $100 million for the Buffer Zone, an adjacent area with undeveloped kimberlite pipes. This is far below $800 million, where apparently BHP started negotiations.

Adding to the surprise, it seems that one of the other bidding companies had a higher offer on the table. Whatever happened, in the last stage of negotiations, Harry Winston succeeded in wrestling the asset out of their hands.

A List of Issues

There is a big difference between Harry Winston and the large diamond companies mentioned above. First, Harry Winston has no mining experience. It received its 40 percent share of Diavik production, unsorted, from Rio Tinto. It will therefore need to learn to manage this hands-on.

More importantly, it will need to work out a sales model. Harry Winston’s main sales channel is its contracted clients. BHP, on the other hand, auctions all its goods. Overall, the auction system worked well for BHP. But will auctioning 4 million carats annually work for the benefit of the market? Many manufacturers are worried that auctions will lead to runaway prices and an unstable supply.

There is also the issue of reputation. For a number of years there has been muted talk that the BHP auction was being "gamed" by bidders agreeing in advance, between themselves, who will buy what goods and for how much. If this is true, Harry Winston will need to quickly untangle this problem, especially if it wants to maximize its returns.

If it chooses to stick to the contracted supply model, it will need to improve its relationship with clients, who regularly grumble about inter-personal dealings with the company. Harry Winston will need to build a better, smarter and gentler sales system, complete with polished price discovery and analysis.

If the purchase goes through – 20 percent Ekati owners Chuck Fipke and Stu Blusson have right of first refusal to buy BHP's 80 percent stake in the mine at the negotiated price – Harry Winston has a great opportunity to step-up its operation. The consolidation of rough supply may or may not work for the industry's benefit, depending on how Harry Winston manages the process.

Most importantly, with such a heavy debt, the company will need to maintain high profitability and keep share prices up – a tough act in a market with decreasing rough prices and rising production costs leading to shrinking margins. If Harry Winston fails with this goal, management may find its shareholders are impatient, forcing swift changes of the kind Cynthia Carroll can tell them plenty about.

Follow Edahn on Twitter

Get in touch on LinkedIn

Connect on Facebook

Or email edahn at idexonline dot com with any questions