OECD: Advanced Economies Improving, Rest Lagging Behind

September 17, 13

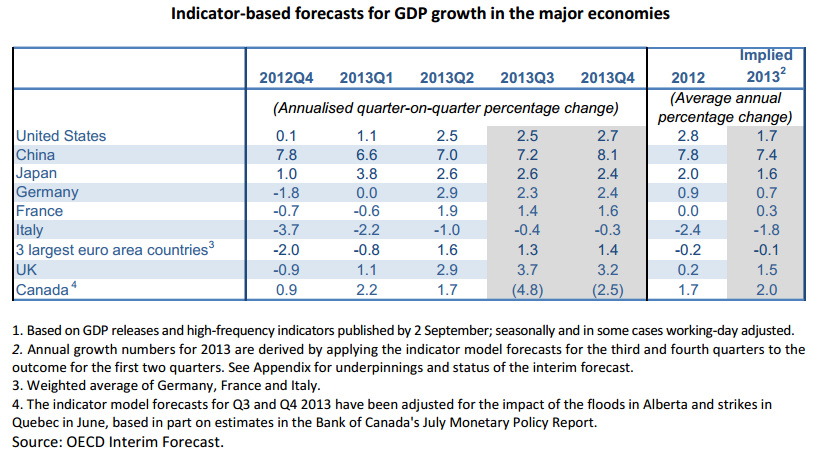

(IDEX Online News) – The OECD reports a moderate recovery in the world's advanced economies, and warns that global growth is sluggish and that risks remain. The report states that second quarter growth in the U.S., China and Japan was stronger than forecast.

“The pace of recovery in the major advanced economies improved in the second quarter and growth is expected to be maintained at a similar rate in the second half of the year,” according to the report.

Furthermore, not only is economic activity expanding at “encouraging rates” in North America, Japan and the United Kingdom, but the euro zone as a whole is no longer in recession, the organization states in an interim economic assessment.

While the leading economies, with the exception of Italy, are doing better, growth has slowed in several major emerging economies. The noteworthy slowing economies are Brazil, India, Indonesia and the Russian Federation – all suffering from large current account deficits.

The concern, according to the OECD, is that as emerging economies contributed strongly to economic dynamism in recent years, this slowdown makes for a continuation of sluggish global growth, despite the pick-up in advanced economies.

OECD says a sustainable recovery is not yet firmly established and important risks remain. “It is necessary to continue to support demand, including through unconventional monetary policies, in order to minimize the risk of the recovery being derailed.”

It therefore recommends reforms to boost growth, including structural reforms and job creation.

How does this affect the diamond and diamond jewelry sectors? In consumer markets with rising GDP such as the U.S., Japan and China, consumer demand for goods is expected to improve, especially for discretionary items.

This, however, will not necessarily translate into growing diamond jewelry purchases. Aggressive marketing efforts are needed to generate this demand.

In the slowing countries, such as India and Brazil, demand may be reduced, although in recent months we are seeing growing purchases of gold items. These purchases should be viewed in the context of investment and not adornment.

|