IDEX Online Research: US Jewelry Sales Hold Steady in October

December 17, 13

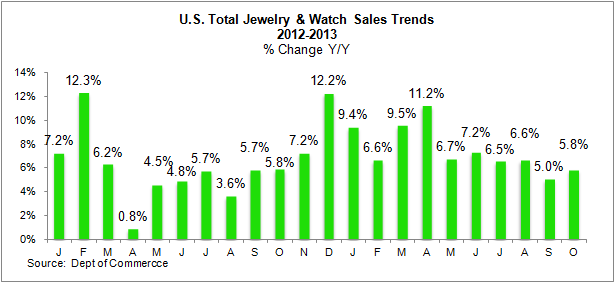

(IDEX Online) – Jewelry and watch sales in the U.S. totaled $5.41 billion in October, a 5.8 percent year-over-year increase, based on preliminary US government figures. In financial terms, the latest figures are largely in line with those seen for September, where revised figures show jewelry and watch sales of $5.45 billion in September, a 5.0-percent year-over-year increase.

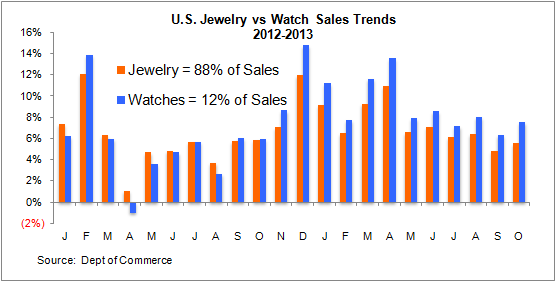

Apart from a slow start in January followed by large jumps in sales seen in February and May this year, jewelry and watch sales have been largely consistent at around $5.4 billion. The changes in percentage terms can be seen in this graph.

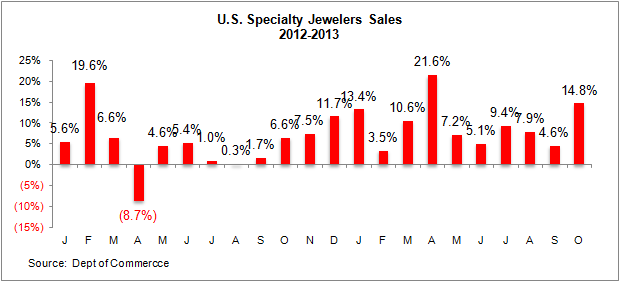

After a fairly sharp decline on the year in September, retailers will be happy to see a change in direction in October ahead of the critical holiday sale season.

The stand-out element was a 14.8 percent rise on the year in specialty jewelers' sales which increased to $2.89 billion. However, this could yet turn out to be a government accounting error and is likely to be revised down next month when new data is published by the Department of Commerce.

U.S. specialty jewelers' have seen monthly sales rises of approximately five to nine percent since May, so a jump of almost 15 percent seems somewhat suspicious. The usual sales pattern, not surprisingly, shows a buildup of sales during the Fall with a climax in the December figures, as the following chart illustrates.

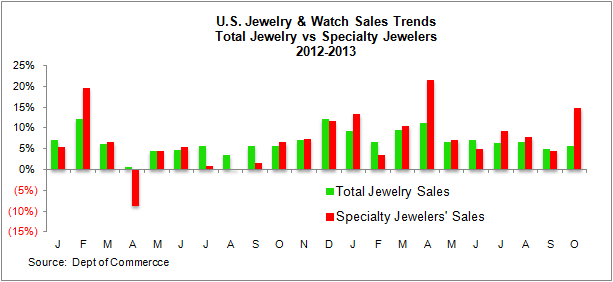

The rise in sales at specialty jewelers in October was also illustrated when compared with the figures for total jewelry sales as can be seen in the following graph.

For the first 10 months of 2013, jewelry and watch sales total $55.5 billion compared with $51.7 billion for the same period of 2012, up 7.3 percent year-over-year. The overall rise in retail sales is below that figure and with inflation running at less than 1 percent, jewelry sales have been higher than in 2012 and put in an impressive performance.

On a positive note, the mid-high single digit increases in jewelry sales is very encouraging, averaging 7.6 percent so far this year. However, the rate of growth has been on a downward trend since June. Again, jewelry retailers will be looking for the holiday season sales of November and December to provide some good cheer and push the monthly averages back up. Since the data for all of 2013 will only be available in February 2014, the retail trade faces a nervous couple of months.

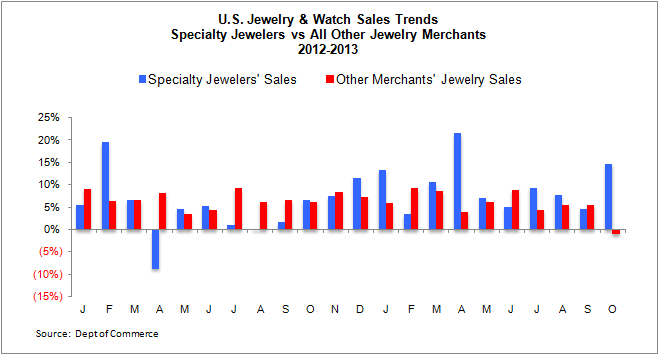

And the power of specialty jewelers to leverage their knowledge and expertise to push through jewelry sales as compared to other merchants of jewelry is seen in the following graph.

It appears to indicate that while other outlets, such as department stores or giant retailers like Wal-Mart have the power to attract vast numbers of customers and can provide the required level of service where the general shopping experience is required, where jewelry is concerned consumers are looking to buy in specialist shops. They clearly require in-depth information relating to the materials used to create the jewelry, including diamonds and trust a specialist to provide those details.

Total Jewelry Sales +5.5%

Jewelry sales alone, excluding watches, totaled $4.75 billion in October, up 5.5 percent year-over-year, based on US Department of Commerce data. Thais well below the rises of 9-10 percent seen at the start of 2013, but nonetheless better than the 4.8 percent increase recorded in September.

Fine Watch Sales +7.5%

Watch sales in October are estimated to have been roughly in line with figures seen throughout the year of an estimated $651 million. However, they were up strongly on October 2012, posting a 7.5-percent increase.

Watch sales account for an estimated 12 percent of overall jewelry and watch sales. This can be seen in the graph below:

While the October watch sales were only marginally down on the September figure of $656 million, they were nonetheless weaker than the $678 million figure recorded in August.

Jewelry & Watch Spending

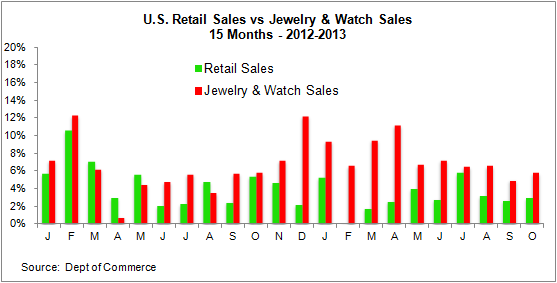

Another reason for optimism regarding jewelry sales can be seen in the following graph, showing that growth in jewelry sales continues to outpace the rise in overall retail sales. Given that the American economy has still not definitively proven that it is on a strong growth path, the figures can be regarded as all the more surprising.

Retail sales overall grew by around 3 percent in October, while jewelry sales jumped by 5.8 percent. That trend has been apparent since the start of 2013, and was more pronounced in the first months of the year.

However, the euphoria needs to be balanced against the fact that annual consumer spending on jewelry and watches, at $70+ billion, is a relatively insignificant element of overall retail sales of $11 trillion.

Specialty Jewelers

Specialty Jewelers market share in October rose substantially from the previous month, accounting for 46.4 percent compared with 40.7 percent in September, leaving 53.6 for other merchants.

Given that these are retailers, as mentioned above, offering a wide variety of goods, such as clothing, handbags and even food and include department stores and discount stores such as Wal Mart, it should perhaps not come as a surprise, ahead of the holiday season, that shoppers are heading for what they regard as jewelry experts rather than general stores.

Outlook

The past 10 months have been characterized by a strong and steady interest among American consumers in jewelry. Although the figures were somewhat erratic through the year and did not show a definite trend, long-term growth appears to be indicated.

That may well be a result of the falling prices of raw materials that are used in jewelry with gold falling by more than 20 percent over the past year, silver down by in excess of 30 percent and polished diamonds largely standing still, though there are categories where prices have show significant increases.

Can the U.S. economy at long last put in a sustained period of growth? Following preliminary estimates of 2.8 percent growth in the third quarter, economists and politicians will be hopeful. Although rising stock markets and housing prices have injected a degree of optimism into consumer opinion, it will take real events on Main Street, meaning significant declines in unemployment, rather than rises on Wall Street, that are a result of the Federal Reserve’s continuing monthly injection of tens of billions of dollars into the American economy, to give a wider spread of consumers the feeling that they can afford to go out and buy diamond jewelry.