IDEX Online Research: Slight Rise in Price of Polished in February

March 04, 14

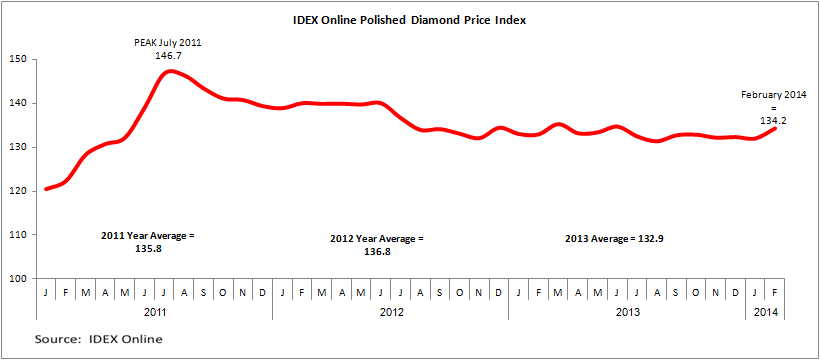

(IDEX Online) – The IDEX Online Polished Diamond Index rose slightly in February to 134.2 compared with 131.9 in January. Round items were all up, apart from 1.0-carat goods which were unchanged.

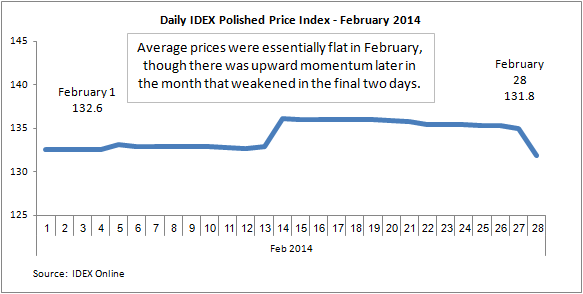

The IDEX Online Polished Diamond Index began February at 132.6 and ended the month down slightly at 131.8 as is seen in the graph below. Prices were for the most part flat during the second month of the year though there was a rise in the second half of February which slipped back in the final days of the month.

A look at the wider picture shows that the index is roughly where it was in mid-2012.

Prices of polished goods made several attempts to move up last year, but failed to maintain the momentum. The first two months of this year, however, show that prices are again moving up. The coming months will provide evidence of whether this push can be sustained.

De Beers said, following the second Sight of the year, that Christmas and Chinese New Year sales had been solid providing a solid base for an increase in polished prices.

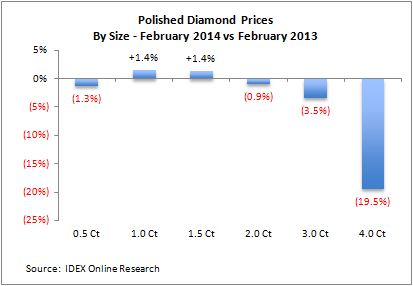

A comparison of prices in February on the year-earlier month shows that the prices of round stones of 1.0 and 1.5 carats moved higher last month, both rising by 1.4 percent. However other categories dropped, with 4.0-carat rounds hit particularly hard. However, due to the lower levels of activity in larger diamonds, relatively few changes can have a large effect.

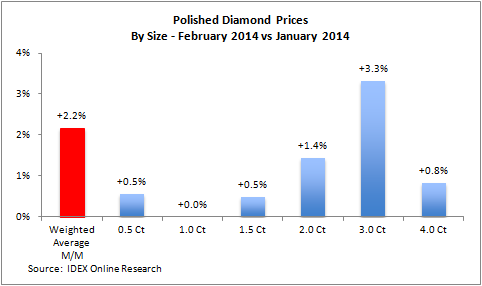

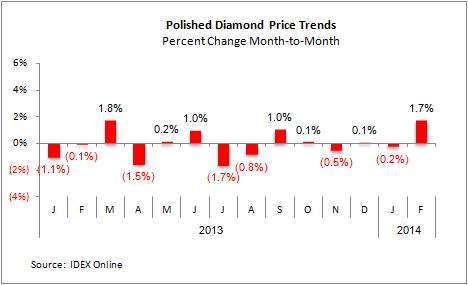

Looking at the month-over-month graph (below), however, polished diamond prices performed well in February. The graph shows that there were rises in all the main sizes apart from 1.0-carat stones which stood still. The stand-out item was 3.0-carat diamonds which posted a rise of 3.3 percent.

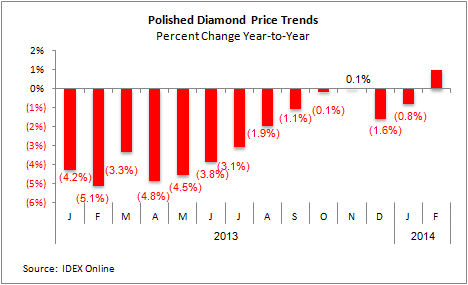

A glance at polished diamond trends (below) shows a rise of around 1 percent last month and an apparent reversal of the trend of the past year.

And the monthly change in price trends was also positive, with a 1.7 percent rise in February from January.

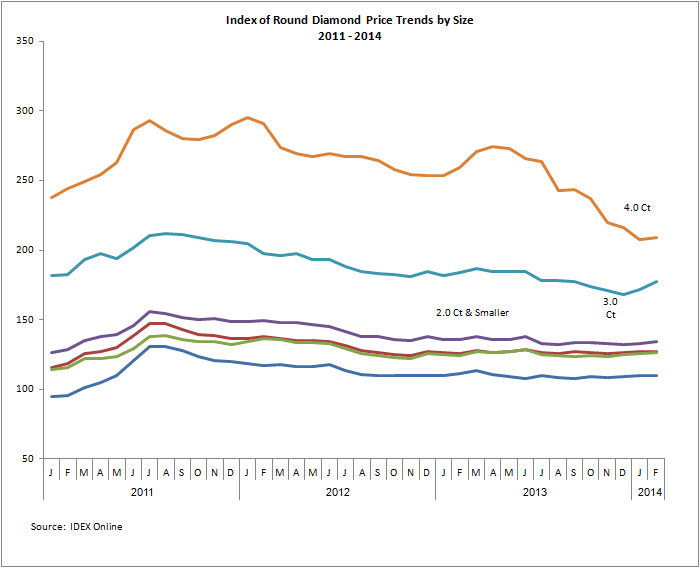

The Index of Round Diamond Price Trends by Size gives a clearer picture of the long-term price changes. The graph clearly shows that diamonds of 2 carats and under are largely flat while larger diamonds are seeing more volatility.

Outlook

The value of goods sold at the second Sight of the year, held last week, is estimated to have been of around the same size as the first Sight at around $730 million.

David Johnson, Midstream Communications Manager at De Beers, reported a positive mood among Sightholders and healthy demand for rough goods. “We are seeing the market move in the right direction. “There has been a bit of a reduction polished diamond inventories after good Christmas and Chinese New Year sales. We are expecting this year to be one of stable growth. Polished prices are not jumping ahead, but rather moving up slowly.”

Johnson said there was “a broad spread of demand” including goods that previously did not see strong demand, and lower levels of refusals and returns than seen in the final months of 2013. He added that the Sight had been “slightly ahead” of the parallel Sight in 2013. “It is encouraging to see polished prices are going up, and healthy demand at the consumer level.” He noted that there was considerable anticipation ahead of the March 5-9 Hong Kong International Jewellery Show which would give an indication of the state of the market.

Meanwhile, Mike Aggett, Managing Director of diamond brokers H. Goldie, said that the Sight was probably similar to the January Sight at around $730 million.

“Although there were a few very small adjustments to box prices, the market was encouraged to see that De Beers did not increase prices across the board to reflect the strong rough market being witnessed in the centres,” Aggett wrote on his blog. “This was widely applauded and seen as a distinct shift in policy to that seen in the past.

“The De Beers sales and management team are now awaiting the results of the forthcoming Hong Kong show in order to gauge demand and further monitor polished prices.” He noted that restocking from China was expected to be strong. In general box mixtures were well accepted with relatively little change in composition noted.”

“Overall polished demand has picked up and in many areas prices have increased, although by nowhere near the levels seen in the rough market. It now appears, however, that the recovery we are seeing is genuinely polished driven. Expectations are running very high for the Hong Kong show in March and restocking from China is expected to be strong.

“Although the current strength of the rough market has brought increased finance back into the industry the liquidity issue remains. The banks are maintaining their pressure while at the same time business is growing, all of which will maintain pressure on liquidity in the short term. If a positive can be taken from this it might be that reduced liquidity could to a degree cap speculative rough pricing which can only be detrimental to the stability of our industry.

“The feeling is there is sufficient liquidity to maintain the current rough market for around another 2 months after which polished that is currently in production will reach the market and liquidity might become more scarce. It will be at this point that a more balanced position between rough and polished should be achieved,” Aggett concluded.

A leading Sightholder with operations in several of the global diamond centers said that rough prices were relatively stable across all categories. "Having said that, rough prices have been pretty strong this year which is challenging for manufacturers as even though polished, too, has exhibited some form of strength, it hasn’t been in line with the move in the rough market.

"This in-equilibrium between the two markets squeezes the margins for manufacturers especially in Africa where our manufacturing costs are prohibitive to begin with. We didn’t find anything special or unusual about the Sight."