IDEX Online Research: Modest Rise In US Retail Jewelry Prices in March

May 05, 14

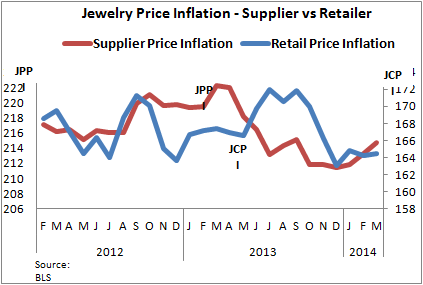

(IDEX Online News) – There was little movement in retail jewelry prices in the United States in March, but an increase was recorded in producer prices indicating a margin squeeze is affecting retail jewelers' profits. A rise in retail prices was posted in January, but the latest figures show that the increase quickly ran out of steam.

The full analysis of the retail jewelry prices data is available to IDEX Online Research subscribers and IDEX Online members here.

Inflation at the supplier level continues to rise, although not dramatically.

JCPI Rises in March

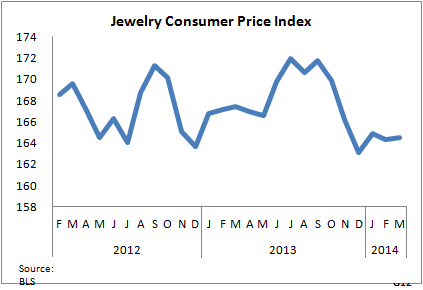

For March 2014, the Jewelry Consumer Price Index (JCPI) stood at 164.5 compared with 164.3 in February. Here’s what this means:

· Retail prices of jewelry essentially stood still on a month-to-month basis.

· Retail jewelry prices decreased by less than two percent on a year-to-year basis: March 2014 versus March 2013.

The graph below indicates the changes in the JCPI over the past two years. There was a great deal of volatility for most of the period, with a low point reached in December 2013.

The JCPI showed a degree of strength in March, and the April figures will show if it has been able to sustain that slight increase.

Are retailers now able to push through higher prices? The JCPI declined in the last months of 2013 as retailers tried to bring in customers by cutting prices and discounting widely. It is possible that with the start of the year and with new styles and ahead of Valentine's Day that stores were able to dictate prices rather more firmly.

JPPI Almost at Standstill in March

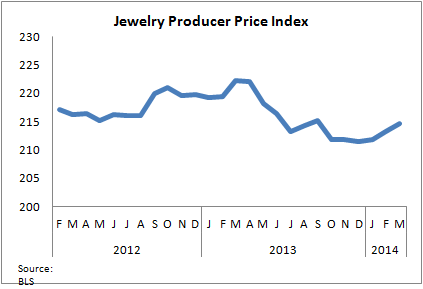

For March 2014, the Jewelry Producer Price Index (JPPI) came in at 214.7 compared with 213.3 for the month before. Here’s what this means:

Wholesale jewelry prices rose somewhat on a month-to-month basis: March 2014 versus February 2014.

However, wholesale jewelry prices fell by 3.4 percent on a year-to-year comparison basis: March 2014 versus March 2013.

The graph below summarizes monthly JPPI over the past two years.

Looking at producer prices since the start of the year, it appears that prices are on an upward swing.

Is the impact of slipping precious metals prices decreasing? Gold, silver, and platinum prices fell throughout 2013, while polished diamonds prices also stood still.

Gold prices have been on the rise however since the start of 2014, holding above the $1,200 per ounce level.

The graph below shows very clearly the directions and trends of the JCPI and JPPI during the past two years. The blue line represents retail prices of jewelry in the U.S. market and the sideways move in February, while the red line shows wholesale prices putting in a spurt since January.

Meanwhile, this graph shows how low inflation was at stores in 2013 when compared with previous years. The 0.5 percent rise was considerably lower than in previous years, especially when compared with the years 2006-2008 and 2011.

Outlook – Inflation Seen Staying Modest

Inflation overall in the United States has been mostly dormant in the U.S. in recent years in spite of the Federal Reserve’s relaxed monetary policy aimed at stimulating growth, but analysts believe it is likely to show signs of life this year. For 2014, analysts forecast a rise in the CPI to 2.0 percent from around 1.2 percent in recent times.

The ongoing battle between consumers and retailers continues to see buyers in the driving seat.

The full analysis of the retail jewelry prices data is available to IDEX Online Research subscribers and IDEX Online members here.

Click here for more information on how to subscribe or become a member.