Polished Diamond Prices Show Small Decrease in September

October 03, 16

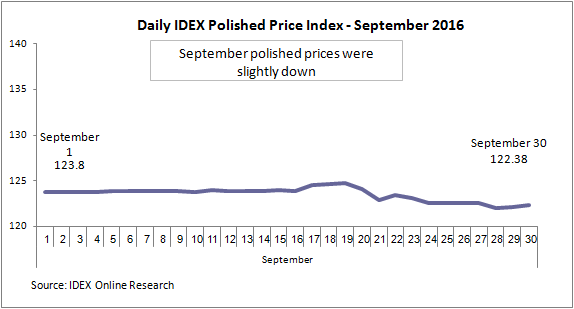

(IDEX Online News) – In September, the IDEX polished diamond price index saw a minor reduction. The Index began the month at 123.8 and ended at 122.4.

The decline last month followed a similar one in August after two consecutive months of largely unchanged diamond prices, with few fluctuations.

Diamond Price Stability Continues

Polished diamond prices have largely shown stability and few fluctuations since November. There was a slight increase between May and June, but the trend shows that September returned toward the June level.

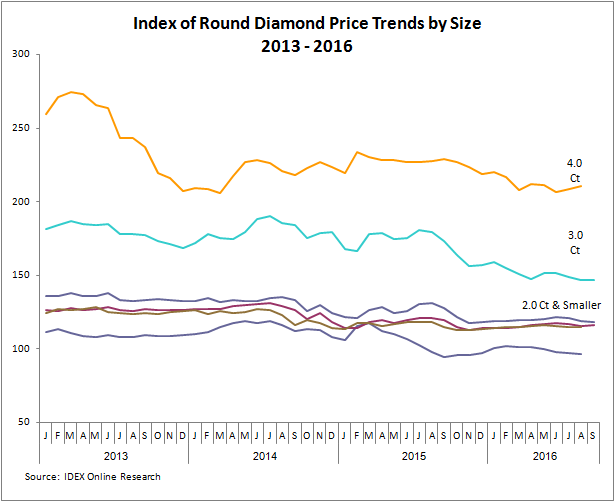

The graph of polished diamond prices since January 2013 shows a 7.0-percent decline to-date.

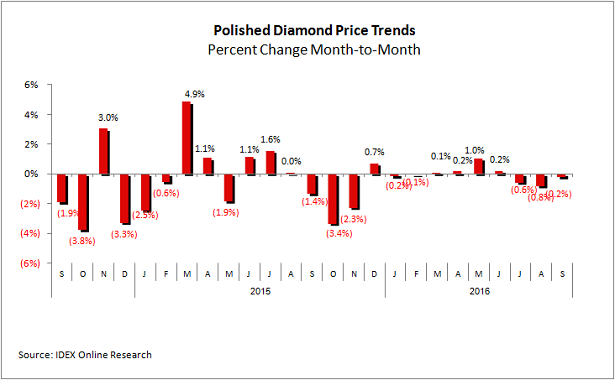

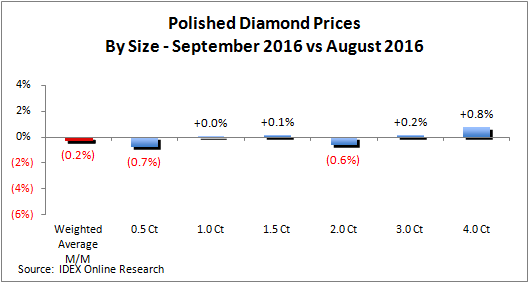

On a month-to-month basis, September's global polished diamond prices saw a slight decline of 0.2-percent decrease over August.

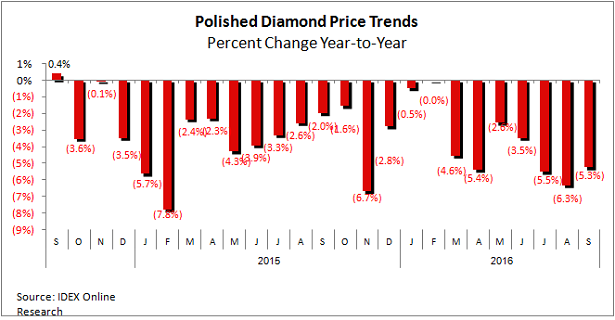

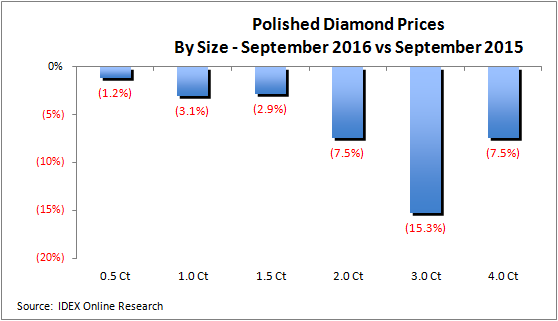

On a year-over-year basis, September's average price showed a 5.3-percent decrease.

Diamond Prices by Size Decrease

On a month-to-month basis – comparing prices during September 2016 to August 2016 – most gemstone categories showed increases, with 4-carat diamonds again rising, this time by 0.8%. The only decliners were 0.5-carat and 2.0-carat diamonds, which showed declines of 0.7% and 0.6% percent, respectively

On a year-over-year basis, all major sizes of stones declined, with 1-carat diamonds down by 3.1 percent in September. 3.0-carat diamonds showed the biggest decline, down 15.3% on the year.

Over the longer term, the general trend is that 4-carat stones have shown the most price volatility, although 3-carat diamonds have displayed the steepest year-over-year decline since mid-2015. Since October 2015, there has been relative price stability in 1-carat, 1.5-carat and 2-carat stones.

Outlook

Despite the heavier than expected foot-traffic and buyer interest at the all-important September Jewellery and Gems Fair in Hong Kong, the market remains brittle. Many traders were expecting September to show renewed strength after the typical weak summer months due to the summer vacations.

The De Beers Summer Sight revealed a rise in prices which served to deter buyers in the secondary market, with Bluedax reporting that this led to a decline in demand and goods were available on the market.

"According to the manufacturers, the only items allowing any sort of profit to be made are non-certified polished goods. Even though demand in the polished market has picked up slightly, there is almost no profit at all in manufacturing certified diamonds due to constant rough price increases since the beginning of the year," the Bluedax blog reported.