US Diamond Jewelry Sales, Are They Rising?

June 05, 14

Every business and every industry always aims at growth. At its simplest, growth is a rise in profit. However, that goal requires growth in other areas. For example, a growth in sales, either in the number of units sold or prices per unit. Ideally, a growth in both. This is Econ 101, the introductory material of economics.

In the diamond jewelry industry, the U.S. is the most important market, followed by China. The U.S. is paramount because most sales and profits are generated in this market. China, demonstrates the largest growth. The duality poses an important question for a company, especially if it’s an international one – where does it put its efforts when trying to grow?

There is no definitive answer to that question, as it depends on the type of goods, brand, access and many other parameters that change from company to company. It is, however, worth understanding the market a little better.

Jewelry sales in the U.S. were rising nominally on a regular basis. In 2011, overall jewelry sales increased by10.7 percent to $61.34 billion, based on Department of Commerce figures. Sales by specialty jewelers, that is, sales by jewelry retailers (as opposed to sales by specialty jewelers plus other retailers that offer jewelry in addition to many other products), increased by 12.6 percent to $29.64 billion.

In the following year, overall sales increased by 6.9 percent to $65.58 billion, while specialty jewelers saw sales increase by 4.1 percent to $30.85 billion. While still growing, sales in 2012 posted a single digit increase compared to a double-digit increase in 2011.

In 2013, the decrease in growth headed further south for jewelry overall as sales fell 10 percent year-over-year to $59.05 billion. At the same time, specialty jewelers were able to maintain their growth, with sales rising 7.8 percent to $33.25 billion.

The bad news is that, overall, jewelry sales in the U.S. are shrinking, but the good news is that retailers who focus on jewelry do much better. These numbers suggest that American consumers are turning their backs on places that offer jewelry along with T-shirts or other non-related goods, at least as far as it concerns jewelry.

In terms of growth, this indicates an interest in higher price point items, as well as more units sold – as long as a jeweler offers it. However, are prices indeed rising?

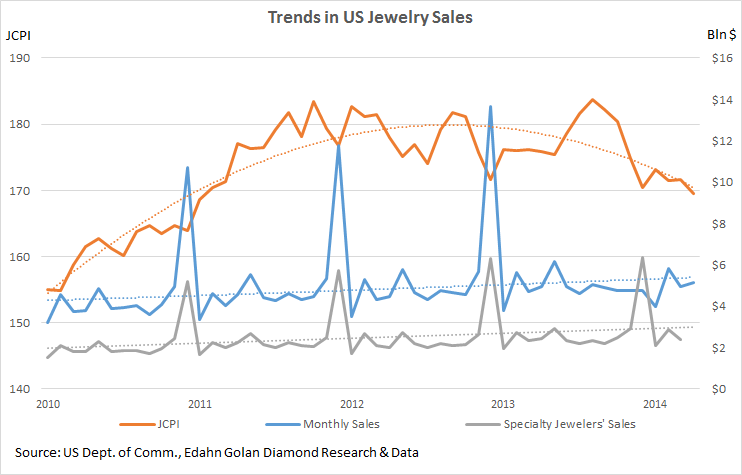

Consider the following graph, comparing overall jewelry sales, sales by specialty jewelers and the Jewelry Consumer Price Index (JCPI) since 2010. The recent decline in overall sales is worrying and possibly indicates a change in direction, but the trend is still positive, especially if we consider improving business in the first four months of 2014. Specialty jewelers (in gray) are also enjoying a positive trend.

Just as a heart monitor charts heartbeats, so do jewelry sales graphs, with the beat taking place at the end of each year, completing a cycle, peaking, providing the entire body with oxygen for the next cycle.

Yet, arching above, is the JCPI, rising from the ashes of the 2008-2009 calamity, jewelry prices have increased, peaked in 2012, and are now sliding downwards. This is a worrying trend.

Here lies a possible threat. Consumers prefer specialty stores to multi-item stores when they buy jewelry, and while at it buying higher price-point items. However, both total overall sales and overall prices are decreasing.

In the past decade, and especially since 2008, more diamond traders and jewelry makers have turned to the East to grow their business. China is the growth market whilst the US is the “Bread & Butter” market. The US provides solid business, but little in terms of growth.

Now there is a challenge. If the figures above teach us anything, it is that the American market is in flux. No surprise, yet that requires avoiding the pitfalls of shrinking sales in one arena, and emphasizing business where there are opportunities – with specialty jewelers, where consumers are heading.

Follow Edahn on Twitter

Get in touch on LinkedIn

Connect on Facebook

Or visit EdahnGolan.com