IDEX Online Research: US Retail Jewelry Prices Drop Again in November

December 22, 13

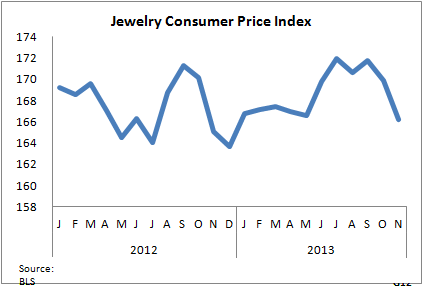

(IDEX Online News) – American consumers saw a further decline in retail jewelry prices last month following modest declines in October and September, while inflation at the supplier level was largely unchanged and moved sideways.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here.

JCPI Declines Slightly in October

For November 2013, the Jewelry Consumer Price Index (JCPI) stood at 166.2 compared with 169.9 in October. Here’s what this means:

- Retail prices of jewelry dropped by 2.2 percent on a month-to-month basis: November 2013 versus October 2013.

- Retail jewelry prices increased by 0.7 percent on a year-to-year basis: November 2013 versus November 2012.

The graph below shows the movements in the JCPI over the past two years, with the outstanding feature being the wide-scale fluctuations in retail jewelry prices over the period.

Retail jewelry prices have moved up and down in a relatively wide range this year, a result of consumer demand for jewelry rising and falling. But retailers can take comfort from the fact that retail spending has remained solid despite the raising of prices by retail jewelers from late summer onwards.

JPPI Stands Still in November

For November 2013, the Jewelry Producer Price Index (JPPI) came in at 211.9 compared with 211.8 for the month before – in other words, it stayed just about unchanged. Here’s what this means:

Wholesale jewelry prices stood still on a month-to-month comparison basis: November 2013 versus October 2013.

Wholesale jewelry prices fell by a sharp 3.5 percent on a year-to-year comparison basis: November 2013 versus November 2012.

Jewelry suppliers’ prices declined from last year’s levels due to lower prices of precious metals including gold, silver, and platinum, while a slight rise in prices of polished diamonds served to cancel out some of the decline in precious metal prices.

Because the overall global economy is still in a slow-growth mode, jewelry price inflation is expected to remain moderate for the foreseeable future.

Key Factors Affecting Deflationary Price Trends in US Jewelry Industry

As precious metals and polished diamond prices have declined this year, both suppliers and retailers are reducing the prices of their goods to reflect deflation in underlying jewelry commodities, as the tables below illustrate.

Inflation Likely To Remain Moderate

What do the coming months hold for jewelry price inflation? It seems clear, at least for now, that prices are constrained by the painfully slow economic expansion in the United States. Sales have remained solid for most of this year, with consumers buoyed somewhat by rising stock markets and house prices.

And the US economy received further good news a week before Christmas with a surprisingly strong jump in growth, the fastest pace in almost two years in the third quarter, as it rose at an annualized rate of 4.1 percent. The growth rate was higher than forecasts of 3.6 percent, and marks a rapid acceleration from the second quarter when the annualized GDP stood at 2.5 percent. The rate of economic expansion is also the highest the country has seen since the fourth quarter of 2011, and the second highest since the recovery began in mid-2009.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.