IDEX Online Research: US Retail Jewelry Prices Increased in January

February 28, 14

(IDEX Online News) – Following several months of declines through the latter part of 2013, there was a rise in retail jewelry prices in the United States in January. The increase followed declines in September, October, November and December.

The full analysis of the US jewelry sales is available to IDEX Online Research subscribers and IDEX Online members here.

Meanwhile, inflation at the supplier level, although showing an increase, it was only a very modest rise.

JCPI Rises in January

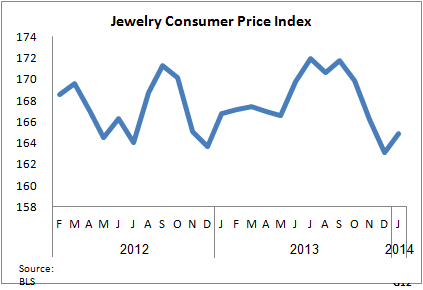

For January 2014, the Jewelry Consumer Price Index (JCPI) stood at 164.9 compared with 163.1 in December. Here’s what this means:

- Retail prices of jewelry rose by 1.1 percent on a month-to-month basis: December 2013 versus January 2014.

- Retail jewelry prices decreased by 1.1 percent on a year-to-year basis: January 2014 versus January 2013.

The graph below shows the movements in the JCPI over the past two years. There were increases through the first nine months of 2013. However, a sharp decline then set in, indicating the lack of power among retailers regarding their ability to set higher prices for consumers.

After four months of declines, have retailers finally been able to break through and push consumer prices higher? The JCPI declined in the last months of 2013 as retailers tried to bring in customers by cutting prices and discounting widely. It is possible that with the start of the year and with new styles and ahead of Valentine's Day that stores were able to dictate prices rather more firmly than previously.

JPPI Almost at Standstill in January

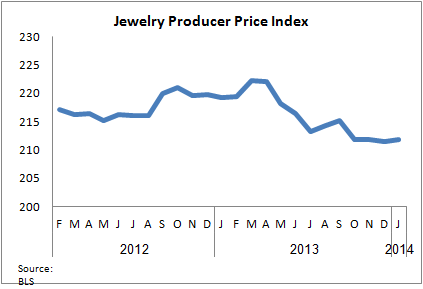

For January 2014, the Jewelry Producer Price Index (JPPI) came in at 211.8 compared with 211.5 for the month before – basically unchanged in January from December 2013. Here’s what this means:

Wholesale jewelry prices were unable to push forward on a month-to-month basis: January 2014 versus December 2013.

Wholesale jewelry prices fell by a not inconsiderable 3.4 percent on a year-to-year comparison basis: January 2014 versus January 2013.

The graph below summarizes monthly JPPI over the past two years.

Clearly, the decline in producer price inflation through most of 2013 and certainly since April last year has been sliding prices of precious metals used in jewelry manufacturing, meaning gold, silver, and platinum. In addition, polished diamonds are, for the most part standing still. Some diamonds, especially smaller round items in commercial qualities, are pushing forward but polished goods prices are unable to sustain rises overall.

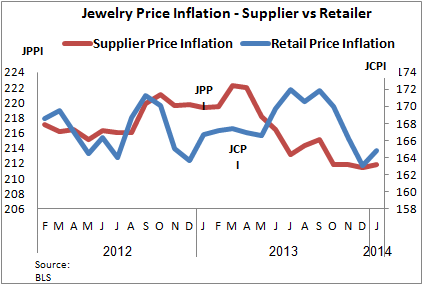

The graph below shows very clearly the directions and trends of the JCPI and JPPI during the past two years. The blue line represents retail prices of jewelry in the U.S. market and the bounce higher it recorded in January, while the red line shows wholesale prices standing still over recent months.

Inflation Seen Staying Modest

With the start of the New Year and with new collections in the stores as well as Valentine’s Day, it was to be expected that retailers would try to boost prices – and that appears to have been the case in January.

The figures for February, which are to be released in the middle of March, will either provide confirmation of this trend or show that it was just a blip in an otherwise tame inflationary environment.

The fight between consumers on the one side, and retailers on the other, is a natural one. Despite the rise in January, it seems reasonable to assume that the trend seen last year will continue.

With the US economy improving only gradually, there is little reason to assume that jewelry prices at the stores can rise as a long-term trend, retailers are probably going to see that the strength in this battle still resides with shoppers.

The full analysis of the US jewelry sales is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.