IDEX Online Research: Slight Fall In US Retail Jewelry Prices In April

May 26, 14

(IDEX Online News) – American retail jewelry prices declined slightly in April from the month before, as did producer prices.

The full analysis of the retail jewelry prices data is available to IDEX Online Research subscribers and IDEX Online members here.

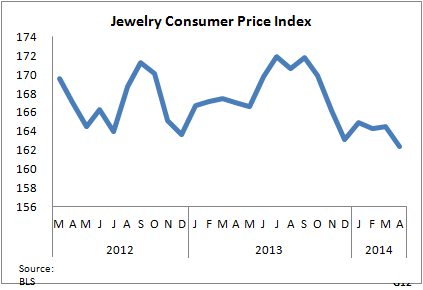

JCPI Rises in April

For April 2014, the Jewelry Consumer Price Index (JCPI) stood at 162.4 compared with 164.5 in March. Here’s what this means:

· Retail prices of jewelry fell back stood still on a month-to-month basis.

· Retail jewelry prices decreased by less than two percent on a year-to-year basis: April 2014 versus April 2013.

The graph below indicates the changes in the JCPI over the past two years. There was a great deal of volatility for most of the period, with a low point reached in December 2013.

Retailers have clearly been unable to push through higher prices. The JCPI declined in the last months of 2013 as retailers tried to bring in customers by cutting prices and discounting widely. At the start of the year and with new styles and ahead of Valentine's Day stores were able to dictate prices rather more firmly, but that effect has clearly fallen away.

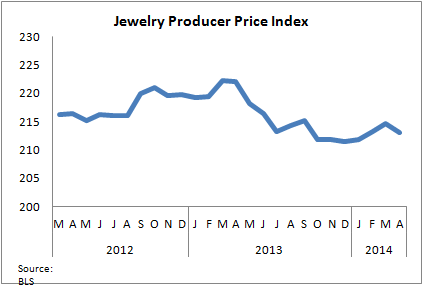

JPPI Almost at Standstill in March

For April 2014, the Jewelry Producer Price Index (JPPI) came in at 213.1 compared with 214.7 for the month before. Here’s what this means:

Wholesale jewelry prices slipped slightly on a month-to-month basis: April 2014 versus March 2014.

However, wholesale jewelry prices fell by more than 3 percent on a year-to-year comparison basis: April 2014 versus April 2013.

The graph below summarizes monthly JPPI over the past two years.

Looking at producer prices since the start of the year, it appeared that prices were heading upwards, but that trend took a hit last month.

That could have been a result of static prices for polished goods in April after a strong spurt in the first quarter, as well as the inability of gold to break higher.

The price of the yellow metal also stood still and failed last month to break the $1,300 barrier. The same was for the most part true also of the price of silver and platinum.

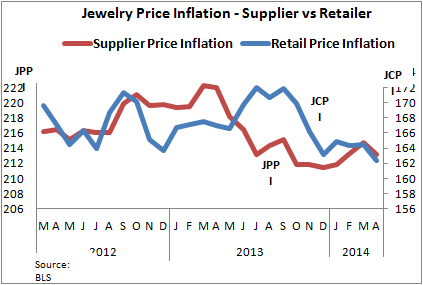

The graph below shows very clearly the directions and trends of the JCPI and JPPI during the past two years. The blue line represents retail prices of jewelry in the U.S. market and the decline in March and April, while the red line shows wholesale prices also declining over the past two months.

There has been a continuing decrease in suppliers’ jewelry prices since last July with a consistent level of decline on a year-on-year basis. Suppliers’ prices have fallen consistently since July 2013.

Meanwhile, the change in monthly retail jewelry prices on a year-to-year basis has declined consistently since December last year.

Outlook – Inflation Seen Staying Modest

With the United States economy still failing to take off strongly, the inflation outlook is rather benign. The Federal Reserve’s continuing relaxed monetary policy aimed at stimulating growth shows that central bankers do not believe the American economy has reached a point where it can take care of itself but, rather, needs continuing help.

For 2014, analysts forecast a rise in the CPI to 2.0 percent from around 1.2 percent in recent times.

The ongoing battle between consumers and retailers continues to see buyers in the driving seat.

The full analysis of the retail jewelry prices data is available to IDEX Online Research subscribers and IDEX Online members here.

Click here for more information on how to subscribe or become a member.